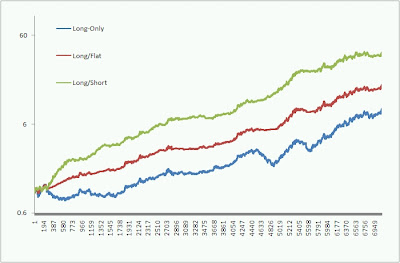

As a follow up to my previous post, “The Next Generation of Commodity Indexes“, I was able to persuade Morningstar to hand over the data from their backtest. Here are the summary results from 1980-2006:

Fairly in line with what I was expecting. The Long/Flat decreased the volatility ~40% from Long-Only, and decreased the drawdown ~ 60% (in my paper the average decrease in volatility was around 30% and drawdown 50%, but the numbers are in the same ballpark).

All three indexes had negative correlation to US Stocks. Correlation to commodities (GSCI) was 0.9, 0.78, and 0.16 for Long-Only, Long/Flat, and Long/Short, respectively. These numbers suggest that adding a Long/Short managed futures fund to your portfolio makes one heck of a lot of sense. Right now the only option for the retail investor is the Rydex fund (RYMFX), but I expect that to change within the year with a less expensive choice.

Equity curve is here:

Some options to invest in commodities and managed futures:

iShares GSCI Commodity-Indexed Trust ETF (GSG)

iPath Dow Jones-AIG Commodity Index Total Return ETN (DJP)

iPath S&P GSCI Total Return Index ETN (GSP)

PowerShares DB Commodity Index Tracking Fund ETF (DBC)

PowerShares DB Agriculture Fund ETF (DBA)

Rydex Managed Futures (RYMFX)