Trading at $980.

In previous posts I talked about round numbers (and why support and resistance works), and how once a trading vehicle breaks through a BIG round number it can fly (ie I expect gold to rip if it breaks through $1000). I mentioned selling $1000 calls and buying lots of out of the money calls as a possible trade.

However, in another post I examined the Gold/Bullion ratio and noticed it is at historically low levels. (GDX seems to me a better bet way to play this trade. DBP is possibly a more diversified choice.)

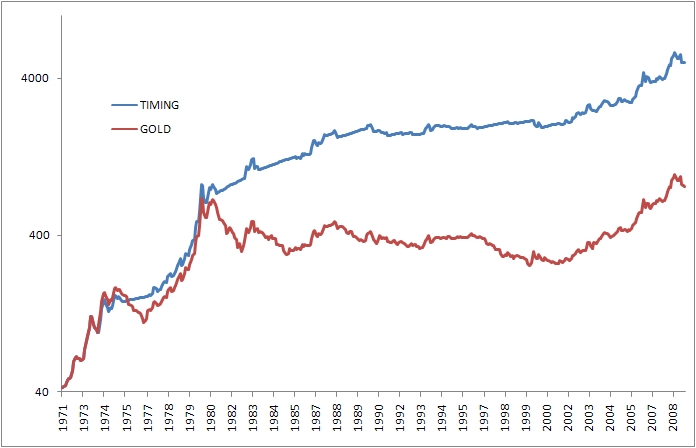

Gold is also above its long term moving average, a setup that generates higher returns, lower volatility, and lower drawdowns than buy and hold. But World Beta readers probably already know that, right? This is probably the simplest trade (with objective buy and sell decisions). Long when above the 10-month SMA, in T-bills otherwise:

I am not a gold bug – I follow the same line of thinking of Ray Dalio when he stated in Barron’s, "Gold is horrible sometimes and great other times. But like any other asset class, everybody always should have a piece of it in their portfolio."

Disclosures: Some clients and family long GLD and GDX. No options positions.