There has been some discussion around the blogosphere regarding returns from strategic asset allocation strategies. Here is a post on the Yale endowment & Swensen’s allocation mix,

With the news that PIMCO is launching a real assets ETF, it now becomes possible to have a truly diversified portfolio with only 3 ETFs. 1 world equity, 1 bond, and 1 real assets. Doesn’t get much simpler than that.

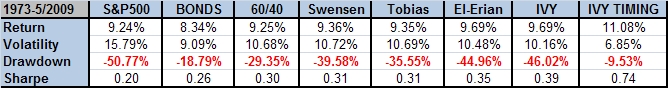

Anyways, I thought I would update an old post on the performance of some lazy portfolios. You can do your own tests over on Asset Play with more granular asset classes, but I am presenting these below mainly to just be instructive. (Who runs this site btw?)

Completely unrelated but nice interview with Paul Samuleson. Part 1 and Part 2.

ALLOCATIONS:

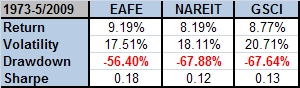

US Stocks (S&P500)

Bonds (10 Year US Govt)

Foreign Stocks (MSCI EAFE)

REITs (NAREIT)

Commodities (GSCI)

60/40

60% US Stocks

40% Bonds

Andrew Tobias Three Fund Lazy Portfolio (Also similar to Bill Shultheis & Scott Burns’s 3 Fund portfolios)

33% US Stocks

33% Foreign Stocks

33% US Bonds

Swensen model, from his book Unconventional Success

30% US Stocks

20% REITs

20% Foreign Stocks (He recommends emerging, but for simplicity we just used foreign developed)

30% Bonds (He recommends short term US and TIPS, but since TIPS only existed post 1997 we lumped them in with bonds)

El-Erian model, from his book When Markets Collide

(This is simplified from his longer allocation. )

15% Commodities

20% US Stocks

15% REITs

30% Foreign Stocks

20% Bonds

Ivy Portfolio (from our book – note this is the B&H allocation not the tactical)

20% US Stocks

20% Foreign Stocks

20% Bonds

20% Commodities

20% REITs

Some nice rules of thumb:

Most asset classes have a Sharpe of around .20 (over time).

A diversified portfolio gets you to around .3 to .4.

Active risk management can improve that to around .7 to .8.

Data from Global Financial Data.

and a few more asset classes: